Understanding Your Rate of Return

Provided by Eric Kala CFP®, CIMA®, AEP®, CLU®, ChFC®, CRPS®

There are a couple of ways to measure performance for your investment portfolio. And you may have questions about the numbers you see. So we created this guide to make things a little clearer.

The two ways we can measure the rate of return on your investment portfolio are using a time-weighted return or an internal rate of return. Sometimes the results we get from each method can be quite different. We’ll explain why in a little more detail, so you’ll have a better sense of how to interpret the returns you see.

Time-Weighted Return (TWR)

With a time-weighted return, we’re measuring the performance of your portfolio’s investment manager. Think of it as the growth rate of a single dollar invested in the account at the start of the period. A time-weighted return allows us to compare returns across managers and compare an investment portfolio’s return against an index or benchmark. Contributions to and withdrawals from your portfolio do not affect time-weighted return.

Internal Rate of Return (IRR)

An internal rate of return (also known as a cash-weighted or money-weighted return) measures the growth of your portfolio using a combination of manager decisions and your contributions and withdrawals. Think of it as your personal rate of return since it’s unique to your investing history. It’s a good tool to help you see if your portfolio is growing enough to meet a future need or a specific investment goal. The timing and size of contributions to – or withdrawals from – your portfolio can significantly affect the internal rate of return, meaning greater weighting is given to those periods when more money is invested in the portfolio.

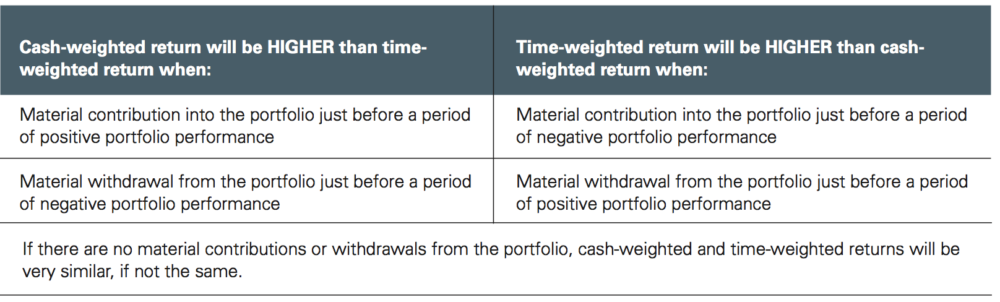

Comparing Time-Weighted Return and Internal Rate of Return

Now that you know the basics, let’s compare them. Time-weighted return and internal rate of return will be nearly the same if you don’t contribute to or withdraw from your account. But cashflows – especially large, material contributions or withdrawals – can result in big return differences.

Let’s Take a Look at an Example

The example below shows the time-weighted and cash-weighted return for an account that began the year with $200,000 and ended the year with $560,000 to better illustrate what we’ve learned.

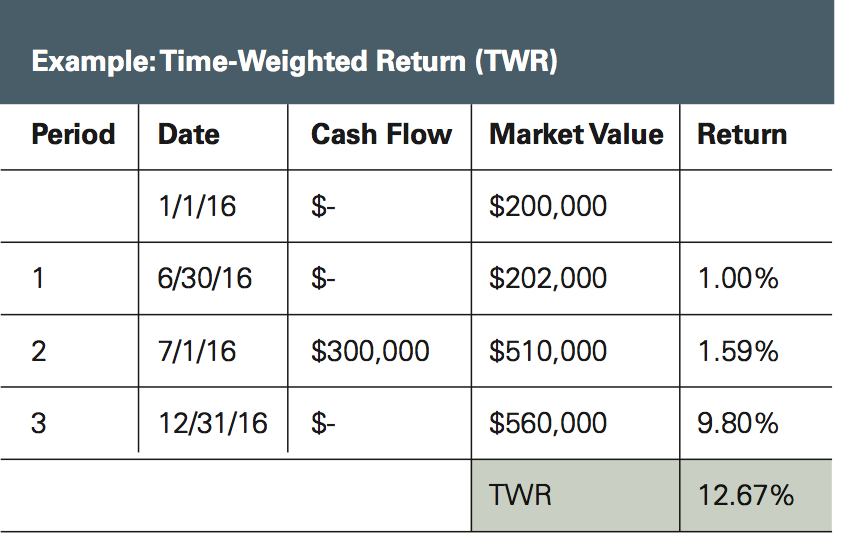

Time-weighted example

Time-weighted example

- The account began the year with $200,000 and increased in value about 1% after 6 months, ending June with a value of $202,000.\

- The account began July 1 with a balance of $502,000 following a contribution of $300,000 made at the beginning of the day. The account ended July 1 with a value of $501,000, gaining 8,000 or 1.59% for the day.

- From July 2 through December 31, the account increased $50,000 in value, ending the year with $560,000 – a gain of 9.8%.

- Combining all 3-period returns, we arrive at a time-weighted return of 12.67% for the year.

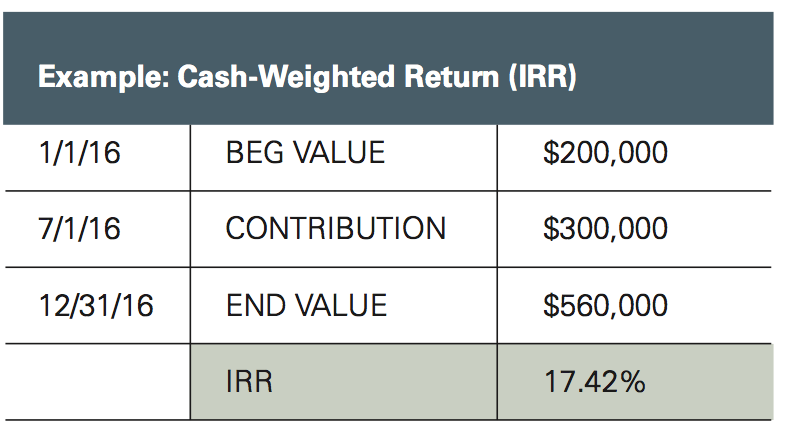

Cash-weighted example

Cash-weighted example

- The account began the year with $200,000 and a $300,000 contribution was made on July 1

- The significant size of the contribution relative to account’s size, coupled with it occurring on July 1, results in performance of the account during the second half of the year having more impact to the cash-weighted return.

- Following the contribution, the account experienced positive performance, growing to $560,000 by year-end.

- As a result of the positive performance after the material contribution, we would expect the cash-weighted return of 17.42% to be greater than the time-weighted return over the same period.

The information is hypothetical and is provided for the informational purposes only. It is not intended to represent any specific return, yield or investment, nor is it indicative of future results.

In review, the 12.67% time-weighted return represents the return of the portfolio’s investment manager. The contribution made on July 1 had no effect on the calculated return. By comparison, the 17.42% return calculated using the cash-weighted method represents the overall growth of the portfolio, considering both the performance of the investment manager and the contribution made on July 1.

So now you can see that both methods are used depending on the questions you want to answer. Time-weighted return answers the question, “How did the manager do?” And the internal rate of return answers the questions, “How did I go along with the manager?” and “Is my portfolio growing enough to meet my investment goals?”

Talk To Your Advisor

Avid Wealth Partners is always here to help. Please talk to your advisor if you have questions about your portfolio’s performance or the returns displayed.

Avid Wealth Partners is always here to help. Please talk to your advisor if you have questions about your portfolio’s performance or the returns displayed.

Avid Wealth Partners

17802 W Interstate 10, Ste. 114

San Antonio, TX 78257

210.446.5751 | AvidWealthPartners.com

Recent Comments