Lower Does Not Always Mean Better (Or Simpler):

An Analysis of The Individual Income Tax Changes of H.R. 1

Contributed by Eric Kala CFP®, CIMA®, AEP®, CLU®, ChFC®, CRPS®

Avid Wealth Partners

OVERVIEW

One of the more significant changes in decades to the tax code occurred with the passage of H.R.1 that affects how individuals are taxed. While touted as “tax simplification,” the end result is anything but that. An initial look at these tax changes reveals both challenges and opportunities for taxpayers and advisors.

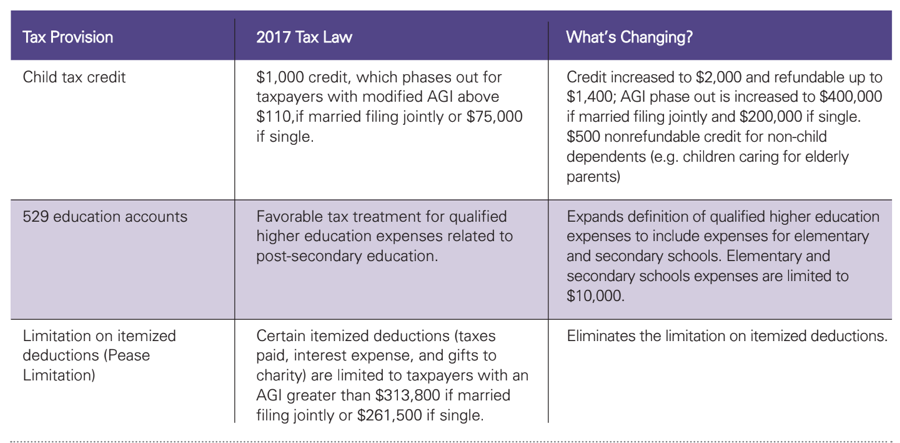

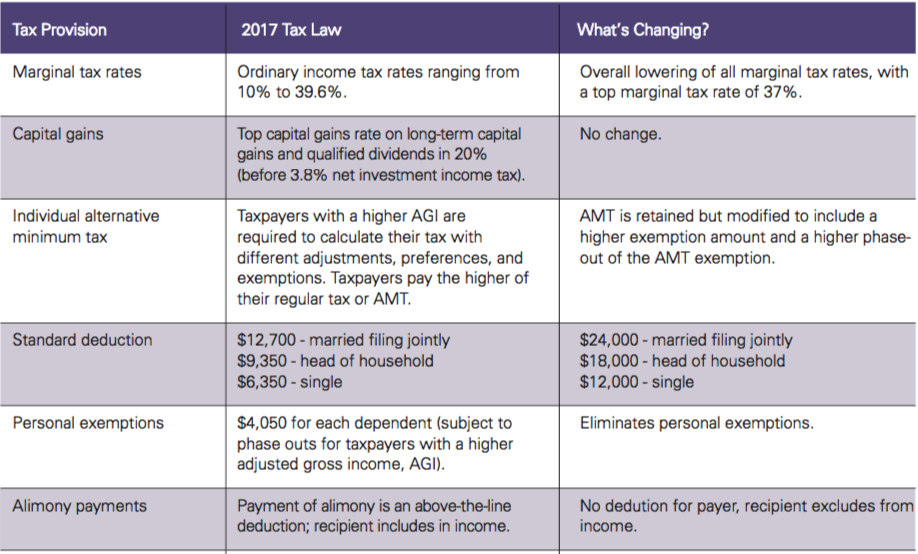

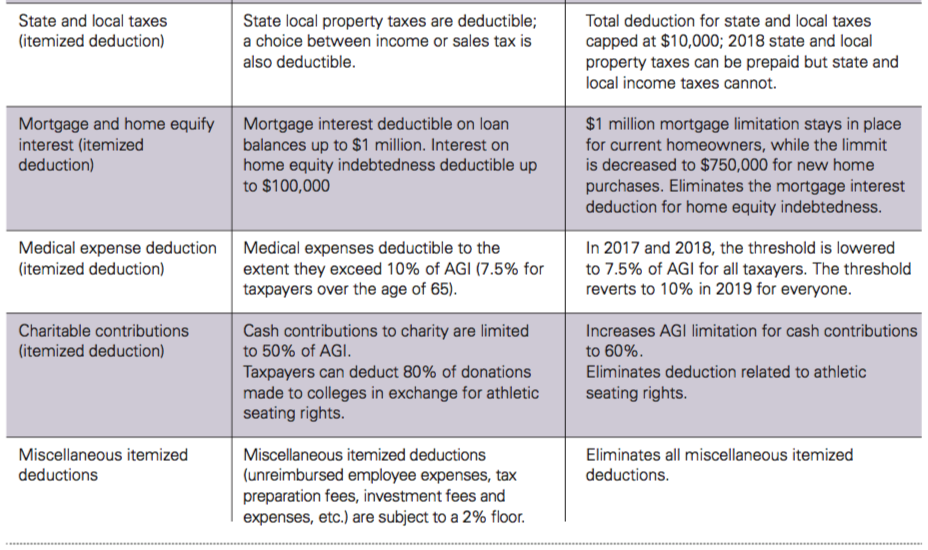

Generally, most of the provisions focus on lowering marginal tax rates and taking away tax deductions and exclusions from income. Because of the Senate deficit rules, many of the individual income tax provisions go into effect in 2018 and sunset at the end of 2025. Here is a summary of the key changes impacting individual income taxes:

COMMENTARY

Simplification? Not so much. Coming at a time when Americans need it to be easy, the new tax law may have the opposite effect and, in fact, not make taxes easier. And certainly, not always lower.

Much of the focus on the new law is on the fact that marginal income tax rates for individual taxpayers are lower, at least initially, with brackets beginning at 10% and topping out at 37%. However, these rates sunset in 2025, and it is likely that individual taxpayers will pay more tax in the long run, particularly if the rates are not extended beyond that time.

Deductions are a bit more complicated and are a mixed bag depending on the taxpayers’ circumstances. Under either existing or new tax law, taxpayers choose between the standard deduction and itemized deductions. Increasing the standard deduction to $12,000 for single taxpayers and $24,000 for joint taxpayers, means that fewer taxpayers will itemize deductions starting in 2018.

The changes will result in a tax increase or a tax reduction depending on each individual taxpayer’s circumstances. Generally, those who currently choose to itemize their deductions rather than taking the standard deduction are expected to see a tax increase (i.e., taxpayers from high-tax states or people who purchase homes and carry a large mortgage balance). Those who currently choose the standard deduction are expected to see a tax decrease.

Although discussions involved it possibly being eliminated, the Alternative Minimum Tax for individuals was retained. Fortunately, it will apply to far fewer taxpayers, as the exemption amount and phase-out for the exemption amount were increased.

CONCLUSION

Now that tax reform has passed, the real work is just beginning. Advisors and taxpayers alike will need to evaluate what it means and how each individual can take advantage of any planning opportunities.

Eric Kala CFP®, CIMA®, AEP®, CLU®, ChFC®, CRPS®

Avid Wealth Partners Affiliated with Northwestern Mutual

17802 W Interstate 10, Ste. 114, San Antonio, TX 78257

210.446.5718

Recent Comments